Suppose you want to get unusual protocols at government offices, excise offices, and airports. Or do you get a discount if you want to replace your old car with a new car? And you want to get all your bank’s conveniences and extra benefits. And in case of any business loss, you need an exemption from paying tax.

You must complete your tax returns and wealth statement to receive these benefits. All of us want to see our country develop. And we want our country to have facilities like the Western world. But most of us are not ready to pay taxes. And we have thousands of false excuses for it. For example, ،many people think our government is not honest, so they don’t pay taxes. As a nation, we lack morals, and for that, we have to develop moral values. How To File Income Tax Returns In Pakistan Online We will briefly guide you step by step in this article.

Income tax returns are the forms in which assesses file information about their IncomeIncome and tax thereon before the Income Tax Department۔

Tax returns for Income are the forms that assess use to file details about their Income and the taxes they pay to the Income Tax Department.

Understanding The File Income Tax Returns Basics

Before the Registration and Filing of your Income Tax Return, it is suggestible that you should establish a basic understanding of these processes. Knowledge of basic concepts would ensure the tasks are performed quickly and befittingly.

TAXABLE INCOME

Taxable Income means Total Income reduced by donations qualifying for deductions and specific deductible allowances.

REGISTER FOR INCOME TAX

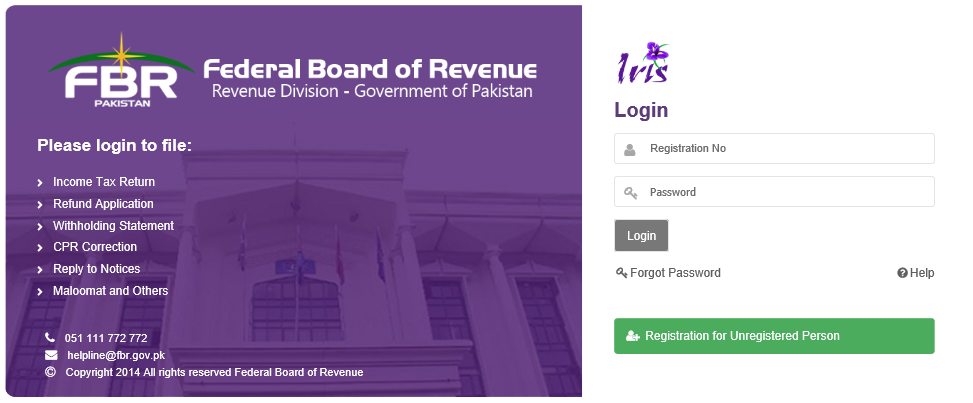

One of the first steps toward filing your income tax return is to sign up for the Federal Board of Revenue (FBR). To register for income tax, people can register online using the Iris Portal.

The principal person in charge of AOP and Company needs to visit the Regional Tax Office (RTO)

TAXPAYER REGISTRATION BASICS

Some essential facts about Registration

A person or a business or association of persons (AOP) or a national of another country will be considered registered when they enroll through the Website of Iris. Using FBR, E-Enrollment gives you the National Tax Number (NTN), Registration Number, and password. For individuals who are not, 13 digits Computerized National Identity Card (CNIC) is accepted as a registration number or NTN.NTN, the Registration number for AOP and company, is the seven digits that NTN you receive following e-enrollment.

These credentials grant access to the online Iris Tax system portal. The tax system portal is the only method to submit online Income Tax Returns.

REQUIREMENTS BEFORE REGISTRATION

A person must be sure that the information below is in place before completing the e-enrollment process.

The requirements for e-enrollment of individuals are in the following order:

- CNIC/NICOP/Passport number

- Cell phone number in use

- Active email address

- Nationality

- Residential address

- Accounting period

- In the context of the case of IncomeIncome from business:

- business name

- corporate address

- The principal business activity

- The name of the company and its NTN in the case of IncomeIncome from salary

- The property address for the case of property income

REGISTRATION PROCESS

ONLINE REGISTRATION

Online Registration is only available for:

Individual, not for Association of Person or Company;

Before registering Online Registration, Taxpayers must possess the following:

A Conceptual Understanding of Registration Process;

A scanner, computer, and an internet connection

A mobile phone that has a SIM associated with their CNIC;

An email address personal to them belonging to them

Document scanned in PDF format of:

Certificate of maintaining a personal bank account under his name;

Proof of ownership or tenancy of business premises in the event of an enterprise;

A utility bill paid for by business premises that is not older than three months if it is an enterprise.

Online Registration is accessible at the Portal of Iris.

REGISTRATION AT FACILITATION COUNTERS OF TAX HOUSES

Registering at the Facilitation Counters of Tax is free for everyone:

Individual, Association of Person and Company;

Sales Tax and Income Tax; Tax

TO REGISTRATION OF AN INDIVIDUAL, THE INDIVIDUAL MUST:

Go to any Facilitation Counter at every Tax House;

The below documents along with you:

Original CNIC;

A cell phone that has a SIM that is registered against his CNIC;

A personal email address that belongs to him

certificate of maintaining a personal bank account under his name;

Original proof of ownership or tenancy of business premises if you have the business.

Original utility bill paid for the business’s premises that are not older than three months if it is an established business.

FILING THE INCOME TAX RETURN

Make an online income tax return by logging in to Iris. Iris can be a web-based platform for Income Tax Returns completed.

For newcomers Income Tax filers, Registration will be necessary before you file an Income Tax Form.

After Registration, you can access Iris and complete your income tax return. If you have a National Tax Number (NTN) or Registration Number but do not have the credentials to access it, Iris can log in by clicking on ‘E-enrollment of the registered persons. ‘

PASSWORD FOR IRIS LOGIN

Electronic enrollment with The Federal Board of Revenue (FBR) will provide you with an NTN, a Registration Number, and a password. You can log into Iris using your Registration Number or NTN and password.

RESET PASSWORD

If you want to change your password to access Iris, click “Forgot Password” on the Iris login screen. Complete all the required information in the fields required.

The codes will be sent to your email address and mobile number. Input the codes into the fields provided. The new screen will appear, and you will be able to reset your password.

CHANGE THE PASSWORD FOR IRIS

The password can be changed by accessing Iris and then clicking “Change Password” at the upper right side part of the page. Write your credentials into the dialog box that appears.

COMPLETION OF INCOME TAX RETURNS

To complete tax returns online, one must complete the Form for Return of Income and the Wealth Statement forms.

The FBR’s Knowledge Base Portal provides step-by-step written and video tutorials on filing income Tax returns and Wealth statements to assist taxpayers.

The Triumphant Income Tax Form and Wealth Statement Submission within Iris are confirmed once both forms are moved from the draft folder to the Completed Tasks.

RECONCILIATION OF WEALTH STATEMENT

The Wealth Statement can only be completed once the wealth of the current year has grown or decreased by the same amount as the preceding year’s total wealth by the same amount your IncomeIncome has surpassed or fallen below your expenses. Failing to resolve your financial statement will not allow you to file your Income Tax Return.

SALARIED PERSON – INCOME TAX RETURN

To assist salaried individuals with their income tax returns Form Declaration 114(I) is available. The salaried individual must complete Declaration Form 114(I) to file their income tax return.

Individuals who only earn IncomeIncome through salary or other sources and where IncomeIncome is greater than 50% of IIncome are eligible for the Form.

CHANGE PIN FOR IRIS

It is possible to have the Pin altered by entering Iris and then clicking “Change Pin in the right corner of the display. Write the required in the dialog box that appears.

COMPLETING INCOME TAX RETURNS

A tax return for Income can be amended within (5) years from completion to rectify any error or incorrect information discovered afterward.

To make changes to the Income Tax Return filed, the taxpayer must apply to revise the tax return in Iris. Once your application is approved, file an amended income tax return in Iris.

REVISING WEALTH STATEMENT

The Financial Statement can be updated in Iris before receipt of the notice in subsection (9) (9) of Section 122 without applying for approval for revision.

FILING INCOME TAX RETURN AFTER THE DEADLINE

To fill in the Income Tax Return online within the deadline, however, you will need to fill out your Income Tax Return in the manner previously described.

Wrapping Up

We try to guide you about Filing Income Tax Returns. I hope you like it. We also wrote a detailed Salary Tax Calculator 2022-23 Pakistan Online article. I hope you will visit this link. We here on this Website always try to write problem-solving articles. Mainly we write on Duplicate bills and e-payments of Gas, Electricity, PTCL, Tax, and Insurance.