Most people are interested in doing government jobs in Pakistan for many reasons. Job security is the main factor. However, salaries are meager in the civil sector. The private sector offers heavy salary packages to their employees but no job security in the Private sector. So civil servants are always worried about taxation and other deduction from their salaries by the government. So every civil service man always wants to know how to calculate income tax due on their monthly salary. We are here to describe all the questions and queries related to income tax. We also share some online links to calculate income tax online easily.

Salary divisions according to Income Tax Ordinance.

Your monthly salary is divided into the following divisions according to Income Tax Ordinance, 2001

- Basic Salary

- House Rent Allowance (HRA)

- Conveyance Allowance

- Medical and Other Allowances

Salary Income Tax Slabs 2023 – 2023

According to the Federal Budget 2023-2024 presented by the Government of Pakistan, the following income tax slabs and rates will apply to salaried people for the period 2023-2024:

- If the taxable salary does not exceed Rs. 50,000, the tax rate for income is zero.

2. If the taxable salary exceeds Rs. 50000 but is not more than Rs. 1,00,000. The income tax rates are 2.5 percent of the amount more significant than Rs. 50,000.

3. Where the salary tax-deductible exceeds Rs. 100,000 per month but is not more than Rs. 200,000, the tax rate is Rs. 15,000 plus 12.5 percent of the sum over Rs. 1200,200,000 per year.

4. Where the salary tax-deductible exceeds Rs. 200,000 per month but is not more than Rs. 300,000, the tax rate for income tax is the tax rate—165,000 plus 20 percent of the total amount, more than Rs. 2,400,000 per annum salary.

5. Where the taxable salary surpasses Rs. 300,000 per month but is not more than Rs. 500,000, the income tax rate is the tax rate: 405,000 plus 25 percent of the amount more significant than Rs. 3600,000.00 per annum.

6. When the taxable salary surpasses Rs. 500,000 per month but is not more than Rs. 1,000,000, the income tax rate is the tax rate—1,005,000 plus 32.5 percent of the sum greater than Rs. 6,000,000 per year in salary.

7. Where the salary tax-deductible exceeds the amount of Rs. 1,000,000 per month, the income tax is at Rs. 2955,000 plus 35% from the sum over Rs. 12,000,000 in a year’s pay.

E-Payment Salary Tax Calculator 2023-2024 Pakistan Online

How do you create An ADC payment for Sales Tax, Income Tax, Tax, or FED and then make its payment online with any bank?

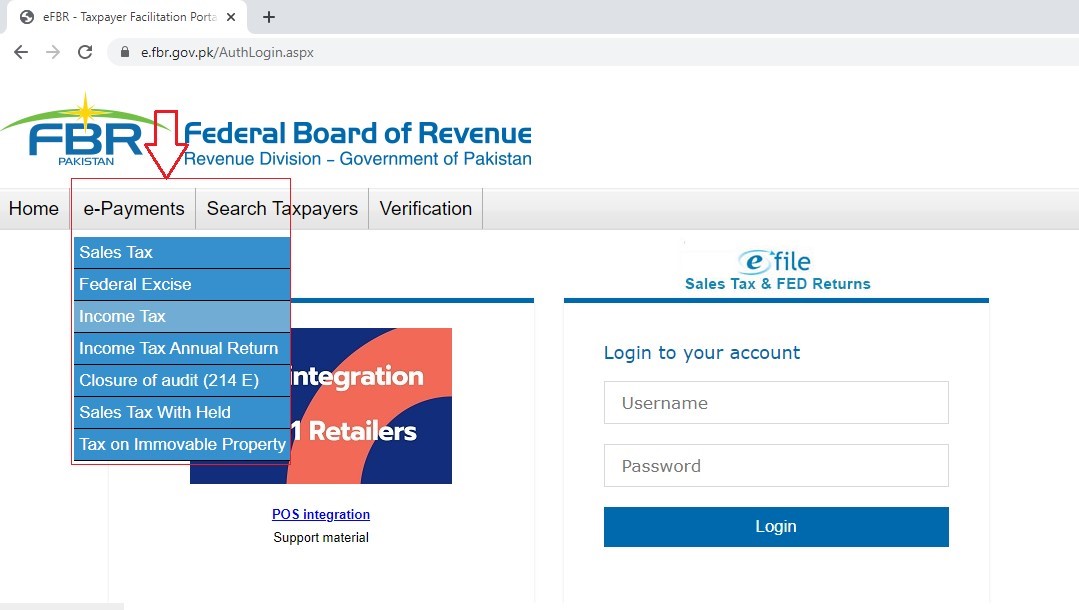

- Visit https://e.fbr.gov.pk/ and press enter button.

- Go to the e-Payments Menu, and choose the payment type as illustrated in the Image above.

- Select “Income Tax” or any other option from the e-Payment menu and click

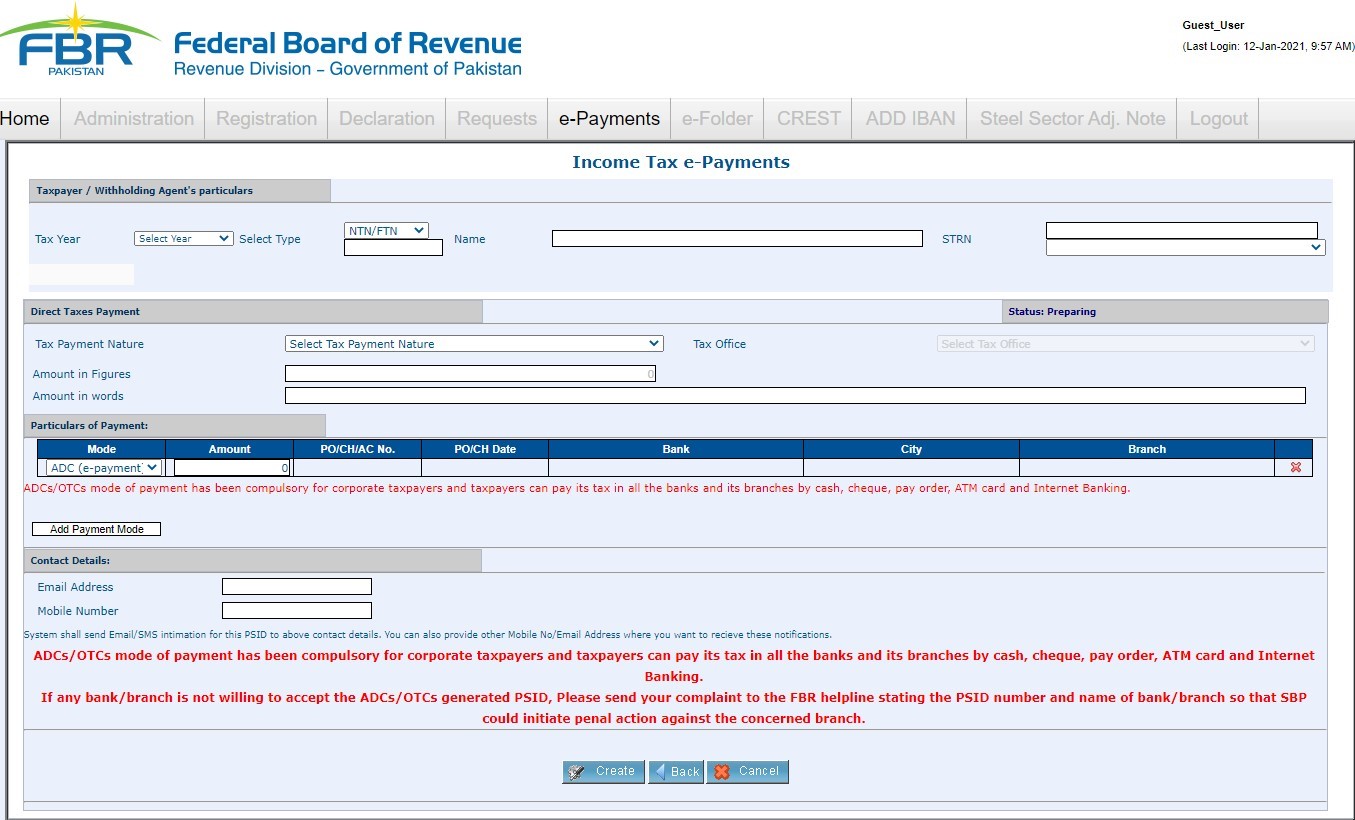

- A new form for payment creation will be displayed as in the Image below

- Complete this Form; begin by selecting “Tax Year” From the Drop-Down List and fill in NTN/FTN and CNIC. No. in the “Select Type” Drop-Down. When you enter NTN/FTN, CNIC, and Reg. No, and then hit “Tab” Name will be automatically filled.

- Choose “Tax Type of Payment” from the Drop-Down menu, as illustrated in the Image below.

- Fill out the remainder of the Form and select the ADC (e-Payment) Option in Specific of Payments, as illustrated in the Image below.

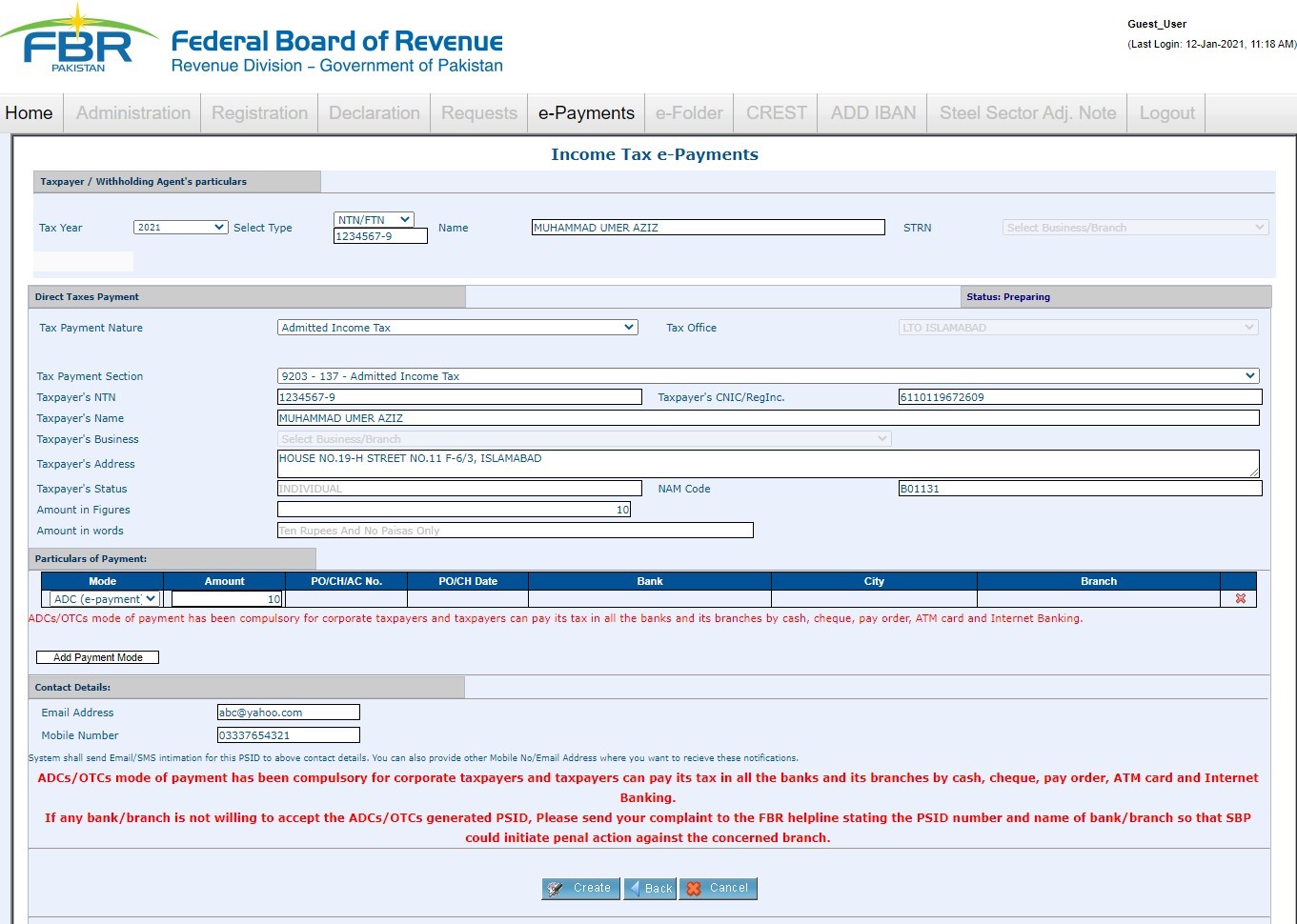

- Complete the Form as in the below Image, be sure to provide your current and correct email address and mobile number. After that, click the “Create” button at the bottom of the Form, as depicted in the below Image.

- Read the instruction in red, ignore any error pop-up, and press the confirms button.

- After pressing”Confirm,” you can confirm your payment “Confirm” button. Once your payment is completed, you’ll receive a PSID (Payment Slip ID) number. Take a printout on the PSID slip and write down the PSID number, as it will be needed to make payments via mobile or online banks, OTC (Over counter payment), and ATMs. Press the “Print” button as illustrated in the Image below.

- Following is an example PSID Slip Print.

Pay Your Income Tax In Bank

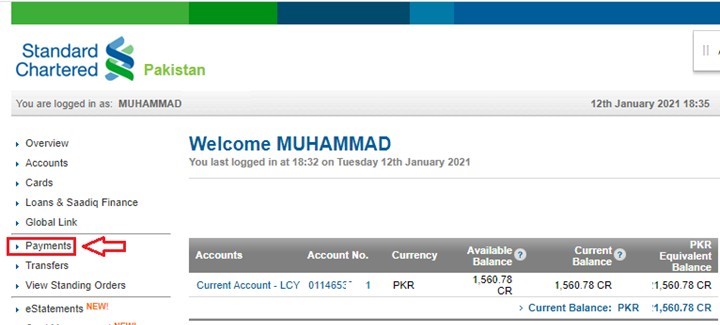

- Now you can access any online banking application for Mobile Banking, ATM, or Visit over the Counter at any commercial Bank branch to pay this PSID. The following steps are for making a payment with standard chartered online banking.

- Go to Bank Website ( Enter your details to sign in.

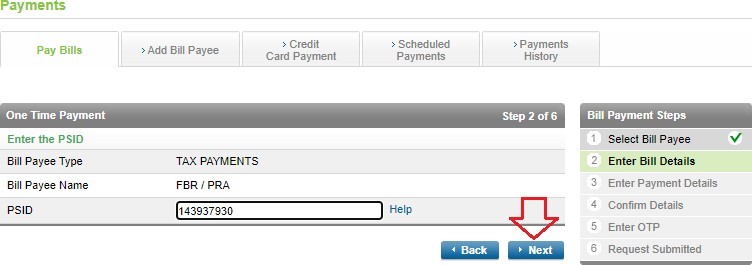

- Choose “TAX PAYMENTS” from the Type of Bill Payee and “FBR/PRA” from the Bill Payee Name, as shown in the image below.

- Enter the PSID you’d like to use for payment in the “PSID” field, then press next.

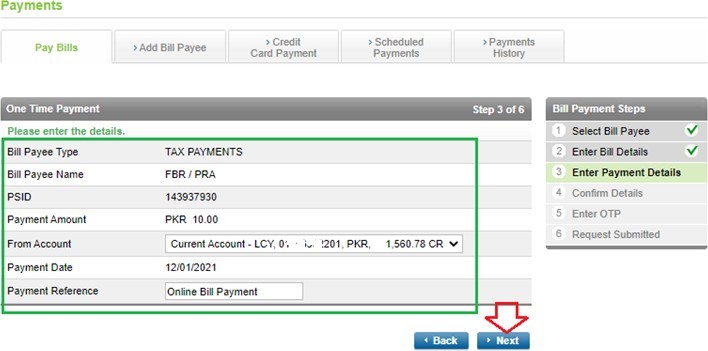

- Check the payment details loaded and then press Next

- You agree to the Terms and Conditions and Click “Confirm.”

- Please provide the OTP as well as the Email PIN for your payment online

Wrapping Up

This article is for the ease of salaried persons. I hope you’ll be happy to read it. However, please contact us if you have any questions about this topic. This website is free and provides solutions about daily life like taxes, insurance, Electricity, Gas, etc.