Tax on mobile phones raises in the last couple of years in Pakistan. There are many reasons for this hike. The main reason is currency inflation against the dollar. Manufacturers of Cell phones are introducing new models with high-Speed performance and HD and cams. Especially new generation intend to buy new phones because of their high performance they need them for Games like Pubg etc. The Pakistani government applies taxes on new and used phones on CNIC and the passport of citizens living abroad. Today you will find detail about How to Check PTA Tax by IMEI Online. It would help to keep all the main things in mind before buying a cell phone.

PTA Mobile Registration Check Online

The process is very straightforward. If you are searching for the current status of your Tax or want to know whether your phone is registered on PATA, follow the process. You need to send your IEME number to 8484. If PTA registers your phone, you don’t need to pay Tax; if you are not registered there, you must follow the below-mentioned process.

Procedure PTA Tax Check Online 2022

Click the link below to Pay your phone registration tax online

https://dirbs.pta.gov.pk/drs/auth/login

- You will see this interface. Click on Sign up.

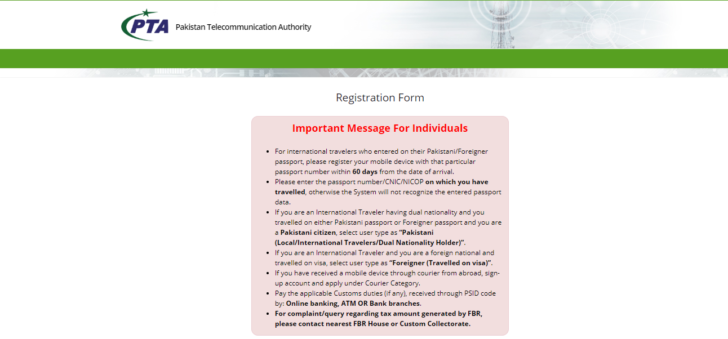

- In the next window, this screen will appear with an important message for you. Carefully read and understand the instructions given in the message.

- Two mandatory options are on the right, Purpose and user Type.

- After clicking on Purpose, two options will appear “Personal” and “Commercial.”

Note: The commercial field is only for FBR Registered importers /companies.

- You must choose the user type after selecting the “personal” option.

- Again, you will be given two options: ‘Pakistani’ (local, international traveller, dual national) and ‘Foreigner.’ Click on the option of your choosing.

- In the Next form window, you must provide your credentials, like your full name, email address, phone number, etc.

- After providing the required information, click submit Button.

- You will receive a confirmation email from PTA.

- After account confirmation, log in with your Email password.

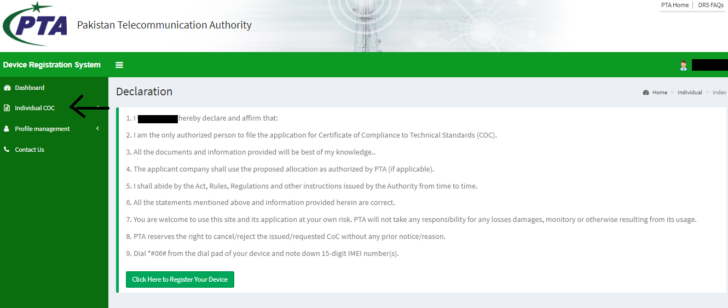

- After logging in, you will see INDIVIDUAL COC on the left corner of your screen. Click it.

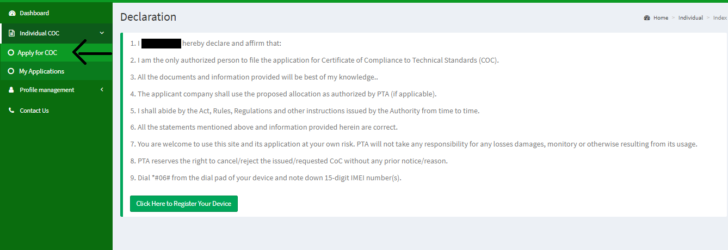

- You Will See Apply for COC. Click it.

- After Clicking Apply for COC, you will see many options on the screen.

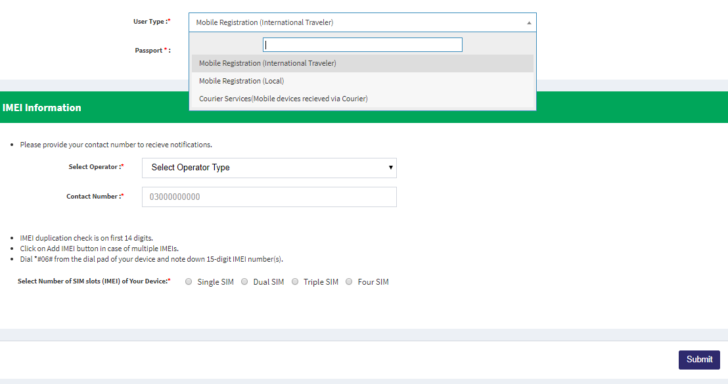

- If you get mobile by Couriers, Choose whether you are an international traveller or local.

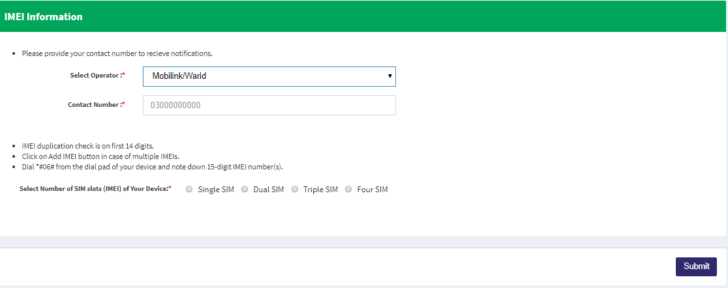

- If you choose the local option, you must provide your cell phone operator and registered sim number against your CNIC.

- Now, select the number of slots on your device.

- Now provide the IMEI of your device. In case of multiple slots, you must provide IMEIs for all of them.

Final Things to Follow to Register Your Mobile Device Online

- After providing your Device IMEI Number, Press/Click the Submit Button.

- After Your details verification, the automatic system will generate a payment Slip ID (PSID) Code.

- With this Code, you can pay your Tax in any Online Mobile Banking, ATM,s Mobile Wallets Like Easypaisa, Jazcash, UBL Omni, and all central banks like Meezan Bank, NBP, MCB, Allied Bank, etc.

What is DIRBS PTA

DVS (Device Verification System) and Pakistan Telecommunication Authority (PTA) introduced this, also called DIRBS (Device Identification, Registration, and Blocking System).

DIRBS control the import of phones, sale, and usage of mobile devices in Pakistan. Through this system, PTA regulate and control smuggled mobile devices and discourage using stolen/illegally imported mobiles.

Wrapping Up

The PSID code is Valid for only seven dayCodef the Code expires; you must apply again for your mobile device registration. We provide all the processes most efficiently. We always try to give an easy solution to our readers. If you are iPhone 14 series user, you must read our article iPhone 14 Pro Max PTA Tax in Pakistan 2022. Note:- You can find your Mobile’s IMEI Number by dialling *#06# from any Phone. Thank you for reading.